I recently had the pleasure of speaking at the Retail Solution Provider Association annual thought leadership summit on the challenges faced by channel partners and vendors in the transition from purchased software and hardware to a recurring revenue service model. Not unexpectedly, one of the hottest topics on the agenda was SaaS channel compensation. In particular, how can SaaS vendors expect their more modest channel partners to absorb the up-front costs of customer acquisition and on-boarding when the SaaS vendors have trouble doing it themselves?

The SaaS subscription model shifts risk from the customer to the vendor.

Shifting too much risk back onto the SaaS channel

lands the SaaS channel partner between the proverbial rock and hard place.

A Game of Risk

The SaaS subscription model shifts risk from the customer to the vendor. SaaS vendors promote low-risk free trials, entry-level subscription plans, and bundled on-boarding, whereas enterprise software vendors expect big up-front license payments and professional services fees. In fact, it is common practice in enterprise software to promote and sell a product before it is completely built or even started. Not so in SaaS. The risks don’t go away though, they just get shifted away from the customer back to the vendor. The SaaS vendor must make big up-front investments in R&D, customer acquisition and on-boarding just like the enterprise software vendor, but it often takes well over a year to recover these costs. If the product fails to live up to expectations; the SaaS vendor is left holding the bag, not the customer.

Between a Rock and a Hard Place

Enter the channel. Acting as a risk buffer is a long-standing value added service of the channel. Some channels exist almost solely to absorb risk, like wholesalers and investment bankers. Enterprise SaaS and software channel partners invest in sales, service and support capacity in advance, absorbing the risk of fluctuating demand. Sitting as it does between the customer and the vendor, the channel can absorb risk from either direction. Too much risk and the channel partner lands between the proverbial rock and hard place. Goodbye channel.

The problem arises when SaaS vendors try to apply licensed software math to SaaS channel compensation. Traditionally, enterprise channel partners net a portion of the license fee, anywhere from 10% to 70% depending on the scope of their services. Simple application of this margin-based compensation model to the SaaS channel can put a SaaS channel partner in the unpleasant position of having to make 100% of the up-front investment in customer acquisition and on-boarding, while only netting a fraction of the recurring revenue stream. Risk shifts from the SaaS customer to the SaaS vendor and right back onto the SaaS channel partner. Rock and hard place.

The New SaaS Channel Math

In my post on SaaS Sales compensation, I made the claims that SaaS vendors should a) pay in proportion to the lifetime value of the deal and b) pay entirely up-front, because the SaaS sales rep should not be asked to bear any of the SaaS investment risk, or the rep is likely to just quit and find better work. The same basic ideas holds for the SaaS channel partner with the caveat that it is reasonable to expect the channel to absorb at least some of the risk, if not all of it. So, when it comes to SaaS channel compensation, SaaS vendors should a) pay in proportion to the lifetime value of the deal and b) pay disproportionately, but not entirely up-front because the SaaS channel partner should not be asked to bear a disproportionate amount of the SaaS investment risk, or the channel partner is likely to just quit and find better work.

The trick is to apply the traditional SaaS channel margin to the lifetime value of the deal, not directly to the payment schedule. The percentage margin or revenue share still reflects the value that the SaaS channel partner brings to the table, but a flat payment schedule does not match the value-added or costs incurred by the SaaS channel partner over time.

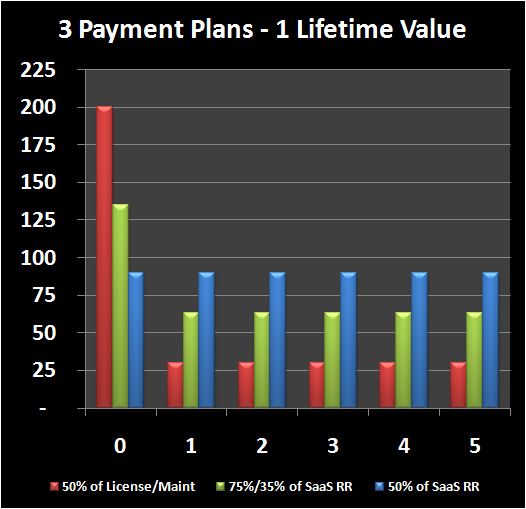

Lifetime Value of SaaS Channel Compensation = % Margin x Lifetime Value of Deal

There are an infinite number of payment schedules for any given lifetime value, offering an infinite number of options that can be tailored to the specific needs of your SaaS channel compensation model right down to specific needs of a single SaaS channel partner. Consider the three payment schedules below with identical lifetime values consisting of a straight out 50% of a recurring SaaS revenue stream (blue), an equivalent license revenue stream of a big up front payment and 20% maintenance (red), and something in between with a 75%/35% split for initial/recurring payments (green).

There are an infinite number of payment schedules for any given lifetime value,

offering an infinite number of options that can be tailored to the specific needs

of your SaaS channel compensation model.

Match SaaS Channel Comp to SaaS Channel Value Add

There is a broad spectrum of SaaS channel arrangements from simple non-exclusive lead referral to complete sales, marketing, service and support in an exclusive territory. Therefore, there is an equally broad spectrum of potential SaaS channel compensation plans. Linking the lifetime value of SaaS channel compensation to the lifetime value of the SaaS channel value add and then matching the payment plan to how that value add plays out over time is the best approach to align SaaS company goals with SaaS channel incentives. For example, a simple lead referral could be immediately paid out as one month of recurring revenue and done. Whereas, a full service arrangement could pay up to 100% of recurring revenue for the first year to cover customer acquisition, but a much smaller percentage over time to cover ongoing support and service.

No Magic Bullet

Linking SaaS channel compensation to lifetime value breaks the direct link to the SaaS customer’s recurring revenue stream and allows the SaaS vendor to provide incentives that better match the SaaS channel partner’s value add and costs. However, it is not a magic bullet. The SaaS customer’s recurring revenue stream determines lifetime value of the deal and thereby limits the total amount available for SaaS channel compensation. If the lifetime value of a SaaS deal is significantly lower than that of the equivalent license deal, the SaaS channel will still face all the usual SaaS challenges of lowering acquisition and service costs through automation and economies-of-scale. Moreover, the SaaS customer’s recurring revenue payment places an upper bound on the potential SaaS channel compensation payment, because it will be the rare SaaS vendor that will stomach negative cash flow by paying out more to the channel than it brings in from the customer. Finally, SaaS Top Ten Don’t #5 cautions early stage SaaS startups against investing in channels too early, and ensures that no SaaS channel compensation plan will overcome lack of primary market demand.

[…] Read the entire post on the Chaotic Flow blogsite:Â Link […]

Here are some thoughts. We have sold saas as a partner for 3 different large vendors since 2004. In 2 cases – we were their largest partner in the channel – by far. All 3 are considered “high ticket” saas systems. But today we focus on consulting and more specifically on cloud management consulting (advising saas companies and other types of companies – either how to scale their technology and/or deploy channels or how to adopt cloud technology to run better). .

There are a couple of things to bear in mind on all of this:

1. for any successful saas company – 50% of total revenue is spent on sales and marketing. A partner is no different. I think this is a point vendors miss all the time;

2. To make selling saas pay for a partner. a. needs to be fairly high ticket. b. you need a commission/discount structure in the region of at least 50% on net new business and 30% on renewals.

3. Partners need to read their contracts carefully – Vendors need to define them carefully and align them with the publicized business objectives they are trying to achieve. Transparency is key here. Partners need to understand what happens when the contract terminates (either by acquistion or for convenience) – in other words, does a partners “payments” survive considering the vendor owns the customer (in saas).

Here are a few pointers for vendors looking at forming a channel or partners looking at joining one.

1. The product. Determine if its a “commodity” product that sells for $20/user or a high ticket product. Its hard for vendors that sell a commodity product to have a vibrant and productive partner channel – specialist services and ISV’s being the exception. By the same token a partner will not make any money selling a commodity product that sells for $20/user.

2. channel infrastructure. All I can say is that very few vendors have a good one. As a partner you need to dig very deep. As a vendor, create a good one if you really want a channel. The problem with this – vendor marketing hype does not necessarily translate to a solid channel infrastructure – the partner normally finding out a bit too late; and the vendor wondering why the partner is not selling.

4. Direct conflict. Amplified in SaaS. Vendors like to take their deals direct given the opportunity – period. Here ROE’s will help – even better a comp neutral plan on the vendors side should eleviate this. Few do it though successfully.

5. Lead Bleed. Significantly applified in SaaS. Customer talks to partner at a show – partner mentions software. Customer goes home and signs up for a trial. Lead lost. There are many ways around this. But few successfully implemented.

5. Contracts. range from rediculous, to vague, to okay – rarely good and fair to both parties.

6. Leads. Dont believe the marketing hype. You will not get leads for subscriptions. Period. The exception being a channel only selling model. This is where I think vendors and partners can work together on making a partnership bi-directional. As it should be.

In summary: channels fail because of mis-matched intentions (on both sides) and lack of transparancy (vendor side). Vendors need to think carefully about their channel strategy and execute it accordingly- and VAR’s need to better understand the inuendo’s of selling SaaS and exactly what that means – because its vastly different to what they are used to on many levels.

Hope all this helps.

We’ve faced this issue and decided that motivated VARS are more important to our success than the upfront income to us, so we have a much higher revenue share to our resellers during the first year of a contract. On our side, we had to build this higher revenue share into our business model and cash flow needs. We also account for this higher revenue share when calculating the cost of customer acquisition.

Insightful thoughts Joel. As I agree 100% with Top Ten Don’t#5, what comes to mind is to define some framework to evaluate a SaaS Vendor’s current business situation before jumping into one of the channel partners. I would possibly consider a roadmap option to acquire channel partner services. At that point , I would prefer channel partners to consider potential revenue ( future) for compensation and also provide the necessary mentoring to SaaS vendors to grow internally enabling more outsourcing possibilities.

[…] This post was mentioned on Twitter by chaoticflow and Marco P., Iskandar Ahmat. Iskandar Ahmat said: Cloud Channel Challenges – SaaS Channel Compensation http://bit.ly/heCkyU Chaotic Flow […]