SaaS channel partners have definitely received the short end of the stick compared to their software channel counterparts. With a few notable exceptions like Salesforce.com, Netsuite (and largest, but least recognized as SaaS, Google AdWords) there simply have not been enough customers or enough work to engender a thriving ecosystem of SaaS channel partners, at least not when compared to the sprawling extent of enterprise software channels. I think this is about to change.

Channels Always Follow the Money

There is one universal law that governs all channel management: CHANNEL PARTNERS MUST MAKE MONEY. The biggest channel mistake made by many a SaaS start-up CEO is to fall into the fantasy that SaaS channel partners are there to help your business. They are not. They are there to help themselves. And, how much money they can make boils down to a very simple formula.

SaaS channel money = SaaS channel value-add x SaaS application customers

And right here is the rub. The self-serviceability of many SaaS applications from customer acquisition through deployment significantly reduces the value-add for SaaS channel partners. In fact, if all SaaS vendors embraced SaaS Top Ten Do #3 – Accelerate Organic Growth, then the SaaS channel situation might be even more dire. Moreover, the number of SaaS applications with enough customers to drive SaaS channel development can be counted on your fingers and toes.

Unfinished Business is the Business of Channels

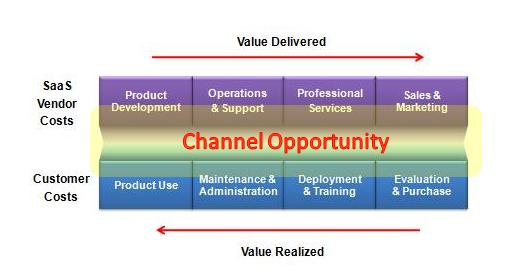

The work required to realize the benefit of your product is the same whether you do it, your customer does it, or a channel partner does it. Channel partners add value by finishing the unfinished work that you and your customer start, but for business reasons can’t complete. They simplify and speed adoption by shouldering tasks that they can do better, cheaper and faster. The greater the gap between your service and your customers’ ultimate needs, the greater the value delivered by the SaaS channel partner and the greater the SaaS channel opportunity.

SaaS Total Cost of Service – Visualizing the SaaS Channel Slice of the Pie

I like to visualize this as the cloud channel partner’s contribution to total cost of service (TCS), because the success of your cloud channel strategy will always hinge on a) your cloud channel partners’ ability to make money and b) your customers ability to realize value that exceeds total cost of service, including the money made by your cloud channel partner.

Developing in the Cloud: The Emerging PaaS Channel Opportunity

The problem with SaaS channels to date is that there simply has not been enough for them to do. I think this is about to change, but I also think it will happen one layer down in the cloud technology stack. If you examine the raison d’etre for the vast array of enterprise software channels it comes down to the fact that enterprise software is delivered in an unfinished state, leaving plenty for enterprise software channel partners to do and lots of it requiring very specialized technical knowledge with which customers simply don’t want to bother.

These attributes are also present in the emerging platform-as-a-service space (PaaS). Whether it is building, deploying and managing a new application on Amazon AWS or simply extending and integrating existing SaaS applications using the ever expanding pool of Web services APIs, the number of opportunities for pure cloud-based development is increasing and is sure to grow to a scale that rivals enterprise software. Unlike SaaS applications that are designed with the business user in mind, PaaS and IaaS offerings are designed for developers. They are by their very nature brimming with potential value, unfinished and highly technical–making them ripe for channels.

Whereas SaaS providers have struggled to develop the interest of potential SaaS channel partners, IaaS, PaaS, and PaaS tool vendors are likely to find their businesses increasingly dependent on cloud channel partners focused on pure-cloud application development and deployment. Moreover, you can expect these cloud channels to spark a proliferation of home-grown development, deployment and monitoring tools that will ignite and accelerate the already hot PaaS tools sector as cloud channel partners product-ize their home-grown systems and take them to market.

So, if you are an enterprise software channel partner and have been scratching your head for the last few years trying to figure out how to jump on the cloud channel bandwagon, then think PaaS channel not SaaS channel. And, get started already or you may miss the boat.

The blog post “SaaS Channels | Cloud Channels Will Follow the Money” from Chaotic Flow explores the evolving landscape of cloud-based channel strategies, emphasizing the emerging opportunities within the Platform-as-a-Service (PaaS) domain.

[…] Stanek, CEO of GoodData, and he coolly pointed out that the solution was right in front of my face: the cloud is the channel. The GoodData BI PaaS platform, puts APIs ahead of BI and cheats the adoption cost barrier outright […]

[…] for me by some of the reactions of my fellow SaaS evangelists to this recent post of the emerging PaaS channel opportunity. As if the emergence of the PaaS channel somehow devalues the “pure†SaaS channel. This is not […]

Joel – Your article is bang on. I hope you don’t mind but I’ve referenced it in one of my recent blog posts http://as-a-service.blogspot.com/2010/05/emergence-of-cloud-managed-service.html

Cheers,

Andy

I agree with Joe and Joel in that there may be opportunity in both models. At the moment there’s no money even for the resellers of PaaS that we talk to. Joel mentioned Force.com and Amazon Wen Services in one of his posts. We went looking around for a successful reseller of Force.com and for all the noise that salesforce makes, we couldn’t find a single one that has even sold a thousand seats. Mind you, 1000 seats may only equal roughly a million or less dollars worth of yearly revenues. The reason most of them cited was that salesforce doesn’t really let them go after any deals. The only way these resellers survive with salesforce seems to be to sell consulting work and let salesforce sell their seats directly. Or in other words, by not being resellers. We also talked to a bunch of Amazon resellers and they still seemed to be struggling to go “live.” I’m also not sure if Amazon is a full fledged development platform, it seems more like infrastructure to me.

So in reality, yes, there is potential in saas and paas models but it has less to do with what the saas or paas provider offers or with what your “value add” is. It has to do more with whether the saas or paas provider has figured out how to make you successful as a reseller and really sees that as crucial to their business model. It has to do with whether you can really resell whatever you are reselling or you are just being tricked.

I agree with you that there has to be a way for the channel to “make money” for their participation to make sense; however, “making money” comes in different shapes and forms. SaaS vendors have to tailor a value prop for each kind of channel. What motivates a reseller to participate is different from what motivates a complementary product vendor, a consulting/implementation company, a platform vendor, a content vendor, or an OEM target, etc. The trick for business developers is crafting that unique value prop for each channel. At its heart, this is no different from traditional software models.

The general maturity of the SaaS model plays an important role here as well. The typical SaaS company focuses first on creating a product and attracting traffic, etc. then turn their focus to channels at a later stage. A lot of SaaS companies are approaching that stage now where heavy focus on channels and business development is overdue. As the issue gets the appropriate focus from smart brains, we will see the evolution of a number of successful models that the ecosystem will congregate around and expect.

So, don’t give up on being a channel for a SaaS company yet … just figure out the “Value Add” in your VAR relationship and the rest will fall in place!!