It’s old news that the Internet has disrupted channel structure across numerous industries. So why go on about the channel now? Because, cloud computing is transforming the Internet as a channel. The evolution from Internet applications that service people (SaaS) to Internet applications that service other applications (cloud computing) transforms the Internet from a direct website channel to an indirect cloud channel and fundamentally alters the economics of the Web. This evolution has already transformed consumer advertising with the rise of syndication and social media, but the impact will not be limited to B2C communication channels. It will deepen and spread through online B2B channels with the rise of cloud computing and platform-as-a-service (PaaS).

|

Twitter is not a micro-blogging website; Twitter is a micro-blogging PaaS. Individual tweets are just not all that interesting, but when you mash them up with friends, colleagues, groups, search, and related Web content, they become a conversation. |

In this post, I’ll provide some concrete examples of how the new cloud channel, or more specifically how cloud computing in the form of Web service APIs and PaaS, is driving a fresh wave of channel disruption that leaves new entrepreneurial opportunities in its wake.

Marketing Channels 101 – A Quick Review

Marketing channels accelerate revenue by streamlining the communications and logistics required to connect buyers and sellers. As such, disruptive improvements in channel cost, velocity and structure can transform industries. Basic channel functions can be categorized as follows:

- Promotion – Communicating the availability and value of a product or service

- Purchase – Facilitating and negotiating the actual sale of a product or service

- Distribution – Cost effectively transporting the product or service from seller to buyer

- Sorting & Packaging – Transforming a raw product or service into a more attractive one

- Risk – Shifting risk from buyers and sellers to channel vendors

Most channels provide more than one of these functions, and on the Internet it can be difficult to tell one from the other as content and applications are fluidly mixed and remixed as they cross the Web. In fact, it is the ability of cloud computing and PaaS to facilitate and accelerate this mixing process that is opening the new cloud channel. Instead of a single threaded link from buyer to seller through the browser, the cloud channel allows sellers to promote through, purchase through, distribute through, resort & repackage through, and shift risk through the network from application to application to application before reaching the final browser destination in front of the buyer.

Cloud Channel Disruption – Promotion

Communication, particularly advertising, is the mainstay of the consumer Web, and the impact of cloud computing on this channel can hardly be overstated. The most obvious example is the role of the RSS standard in transforming content distribution from a direct channel ruled by websites and portals to a cloud channel ruled by syndication and sharing. The combination of this standard data exchange format with Web service standards has created the penultimate “promote through” cloud channel as content is passed from blog to news site to friend to tweet and so on. It is the technical underpinnings of cloud computing as machine-to-machine interaction that enables the far reaching content syndication and person-to-person interactions of social media. Web service APIs create the conduit of the cloud channel, while the RSS standard makes the cloud channel indeterminate, organic and viral.

Cloud Channel Disruption – Purchase

Unlike blog posts and tweets, financial market data like real-time stock quotes is content of such high value that it still costs real money. In fact, according to Burton-Taylor the market for financial information and analysis is a $23 billion market. Unfortunately, market data is also incredibly difficult to buy. Mirroring the enterprise software model, market data is mostly purchased offline through third party data providers in the form of bulk, complex data feeds that require lots of on-premise data management software, hardware and professional services to parse, scrub, store and serve it to final applications and invariably force customers to buy and manage more market data than they actually consume.

Delivering market data over the Internet using standard Web service APIs, Xignite transforms the way market data is both bought and sold. Market data powers financial applications like electricity powers kitchen appliances. The Xignite market data cloud channel creates a power grid that connects the generators of market data: stock exchanges, trading networks, major brokers, etc., directly to financial applications using a Web service API as the standard socket. Immediate online access allows prospects to evaluate data fit and quality before they buy. Transparent, usage-based pricing facilitates online purchase. Web service delivery enables real-time sorting and packaging of the data to meet specific customer needs in a fashion unavailable to bulk data feeds, allowing customers to consume and purchase only the data they need. By simplifying and accelerating purchase, data providers like NASDAQ and CME Group can reach a wider global audience, including customers that can’t afford the time, effort and cost of buying a traditional data feed product.

Cloud Channel Disruption – Distribution

Application adoption and customer on-boarding is a primary challenge of every SaaS startup. While shuffling snippets of content around the Internet may satisfy the monetization needs of many a B2C Web business model, B2B SaaS companies need to move product to make money. Without APIs, the distribution channel of a SaaS application is limited to a single URL and adoption is constrained by the manual processes available from UI tools and professional services. For data-integration-intensive SaaS applications, such as BI and ERP, the adoption cost challenge seems almost insurmountable as highlighted IMHO by the failure of LucidEra and elusive profitability of NetSuite.

Frankly, I’d almost given up on these SaaS categories until I recently put the question to Roman Stanek, CEO of GoodData, and he coolly pointed out that the solution was right in front of my face: the cloud is the channel. The GoodData BI PaaS platform, puts APIs ahead of BI and cheats the adoption cost barrier outright by leveraging the cloud channel. While most SaaS BI startups sell direct, relying on low TCO and enterprise sales prowess to motivate customers over high adoption costs, GoodData plans to drive distribution through the cloud channel with a ground-up PaaS architecture, canned integration to major SaaS applications, cloud solution partners and strong support of its developer network. The SaaS BI space is crowded, competitive and unpredictable, but pure-play PaaS is the strongest and most disruptive strategy I’ve seen to date, because it focuses like a laser on eliminating the biggest obstacle to SaaS BI adoption, data integration.

Cloud Channel Disruption – Sorting and Packaging

If you use Twitter, chances are you don’t really use Twitter.com, because seventy-five percent of Twitter traffic flows through its APIs. That means that most people are using Twitter just about everywhere else, like their mobile phones, Facebook, LinkedIn, TweetDeck, and Seesmic just to name a few. Twitter is not a micro-blogging website; Twitter is a micro-blogging PaaS. Individual tweets are just not all that interesting, but when you mash them up with friends, colleagues, interest groups, search, and related Web content, they become a conversation. Had Twitter taken on a portal strategy common to social networks like Facebook, chances are it would have failed miserably. By allowing developers to easily repackage Twitter to meet the divergent needs of a myriad of market segments, Twitter leverages the cloud channel to drive adoption and use, while remaining focused on the core value of it’s service.

Cloud Channel Disruption – Risk

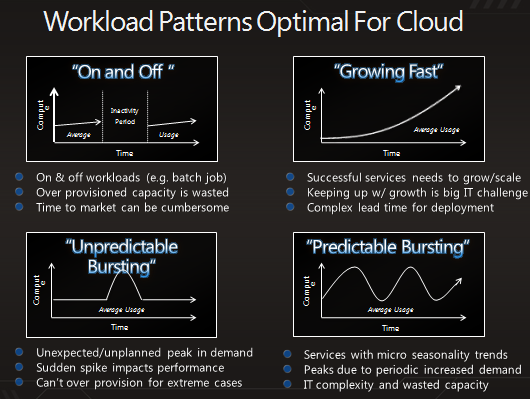

A common objection is that the cloud is just too risky. This despite the fact that only the largest IT organizations can come close to internally matching the dedicated expertise, SLAs and security of established SaaS and cloud companies. However, it is important to remember that the role of the channel is to absorb risk not shirk it, particularly inventory risk. On the cloud channel, inventory is measured in IT workloads, and the more unpredictable the workload, the higher the risk of managing it in-house, and the greater the value in shifting it to the cloud. I especially like this slide that the Windows Azure folks put together to illuminate this concept.

The cloud channel absorbs the risk of fluctuating IT workloads through shared infrastructure just like a wholesaler absorbs the inventory risk of fluctuating demand for physical goods.

As the cloud channel matures, I believe it will become more effective at absorbing risk of all kinds. While there are certainly applications where privacy, security and compliance concerns may permanently preclude moving them to the cloud, the vast majority of applications will succumb as the technology advances. Ten years ago, many businesses would have balked at putting their customer databases on the cloud. Now it is a common practice that Salesforce.com has turned into a billion dollar business.

The most common fallacy of the cloud channel is the illusion that control reduces risk, when in reality it is simply a reaction to fear. But, fear of flying doesn’t make you a pilot, and you probably aren’t safer flying the plane yourself.

Hi Walter,

Honestly, I’m still wrestling with the “private cloud boundary” myself and I’ll likely write a follow up post on it, but here is my current thinking.

Both the value and complexity of a cloud, public or private, increase with size. On the low end of IaaS, I expect server O/S vendors will turn the complexity into a commodity and we will see more “cloud in a box” solutions that are direct replacements for racks of Windows or Unix servers. It’s just a more flexible model. Firms will be willing to spend the same cash they spend today if they can get more agility.

But, at the PaaS and SaaS layers and the high end of IaaS beyond a single rack of servers, the complexity and cost of managing APIs, applications, and highly distributed infrastructure would have to be countered by extreme security, privacy and compliance requirements for firms to maintain them in-house. And, you will see specialty cloud providers that guarantee high security, privacy and compliance. So, only the biggest firms would be able to manage such infrastructure at all and moreover do it better than a specialist (thinking Fortune 1000).

But truly, it is more a question of what percentage of IT workloads by layer (IaaS/PaaS/SaaS) than what percentage of IT departments. Because, even large firms will opt to outsource low risk applications and infrastructure. And, small firms will keep in-house very high risk applications as long as they can afford it.

On the high-end though, here is a timely post from Sandhill.com on 7 Key Requirements of Private Clouds. So, the real boundary would be determined by asking the question: “Can your IT department meet these requirements cost effectively? Or, at all?”

Cheers,

JY

Great post, fabulous information and those links require quite a bit of research as follow-up. I’ll ask you something about what is probably the most pedestrian part of your post, but that’s the part I can get my head around at the moment!

“only the largest IT organizations can come close to internally matching the dedicated expertise….” Couple of questions (1) how large is large, we know eBay has gone hybrid cloud, and it’s been promoted as a likely cost effective solution for many others, yet I wonder in reality if this is really only 1% or less of the world’s IT shops, not the 40 or 50% that IT managers are grasping for – the other 99% would all be served by cloud in the end, (2) what do you think of so-called “private cloud” in this context?

The Azure slide shows the cloud value, and it could also be used to show “hybrid” value by those who want to promote private cloud as taking the base workload. I know that the shift won’t happen overnight, we’re talking 5 to 10 years I imagine, but other than “enterprise sales prowess to motivate customers over FUD”, which will be well exploited by the private cloud leaders, is there any real value in private cloud for the majority of businesses?

Walter Adamson @g2m

http://xeesm.com/walter