The BridgeGroup recently surveyed 115 North American technology companies with a special focus on SaaS inside sales metrics and sales compensation for SaaS companies. As SaaS sales organization, metrics and compensation have all been recent topics here at Chaotic Flow, and since it’s always best practice to test theory with reality, I thought I’d share and comment on some of the results.

According the survey, about 50% of SaaS inside sales organizations segment hunters from farmers. Of those that do, the average ratio of hunters to farmers is 2:1.

The report covers lots of great questions from average deal size to organization size and focus as well as compensation. Of course it is an informal survey, so it is what it is, but I found that many of the results jive with my own internal SaaS benchmarks. For example, the average quota for a SaaS inside sales rep was 800K ARR while the average total annual sales compensation was 100K with a 54:46 split of base to commission. These are critical benchmarks for the average SaaS startup, because in the few years after launch a quota of 800K is all but unattainable and it is essential to have a long term goal for target quota in mind in order to manage your acquisition costs.

Without considering benefits, T&E or overhead, the percentage benchmark contribution of direct SaaS sales labor costs to customer acquisition cost is then 100K/800K = 12.5% Whether and how fast the SaaS sales VP attempts to achieve this target depends on growth objectives, local labor market rates and retention goals. I should also comment that 12.5% is a superb SaaS best practice benchmark if the SaaS sales rep is the only person orchestrating the sale and indicates a highly transactional SaaS sales model. If your SaaS sales organization includes ancillary staff, e.g., lead qualification, technical support for on-boarding, account managers, etc. then your true ratio is not 12.5%, because you need to include all labor applied directly to the sale.

I did find it interesting that the reported average quota based on monthly recurring revenue was lower than the annual figure, i.e., $4,460 MRR per month implying an annual quota of $640 ARR per year. My initial reaction to this is that SaaS sales organizations that choose monthly recurring revenue as their unit of measure probably have much higher velocity sales cycles with simpler products and lower average sales prices. This is consistent with the SaaS best practice that you should choose a SaaS sales compensation measurement period (MRR, QRR, ARR) that fits your SaaS sales cycle to ensure a more intuitive understanding of metrics and compensation plans throughout your SaaS inside sales organization.

The survey also found that 65% of SaaS inside sales organizations target both SMBs and enterprise customers with an additional 8% targeting enterprise alone, leaving only 27% that target SMSs exclusively. This fit well with the lifecycle analysis of the report, which showed a surprisingly high 54% of the companies surveyed having “crossed the chasm.” Startups under $5M represented about 27% of respondents. So, overall there is a healthy mix of SaaS companies participating in the survey at varying stages along the typical SaaS sales model evolution path.

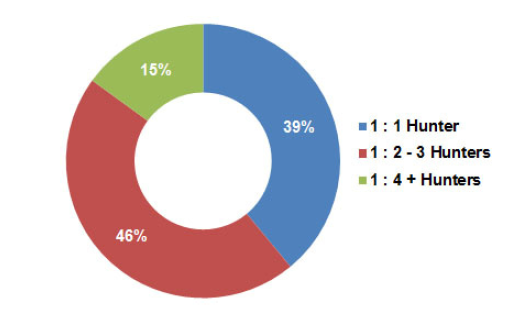

Lastly, and not unexpectedly, the biggest challenge of SaaS inside sales organizations is…drum roll…you guessed it: Leads! Net net…I highly recommend checking out the complete SaaS best practices report on inside sales from BridgeGroup. I’ve only touched the surface in this post as there are also questions hunting vs. farming, trial conversion, and even calls per day. The report is free, but does require registration.

The Open Current directory provides many more cloud & SaaS best practices. If you want to receive updates on Open Current cloud & SaaS best practices, you need to subscribe separately to the Open Current RSS feed. Also, suggested new entries to Open Current in the form of surveys, benchmarks, white papers and blog posts that represent cloud & SaaS best practices are always welcome (hence the “open”), but must be of the highest quality information and very light on the promotion side, i.e., independent blog posts, serious industry research, or fantastic content marketing.

And, if you see something you like at Open Current, please do right by the author and give it a tweet!

What would be the best marketing strategy for a cash strapped SaaS startup offering solutions to small businesses?…

Three things to do before you spend any money: 1. Identify your market very clearly. The more your sales and marketing effort is focused on a well-understood, well-defined target buyer, the more effective it will be. Your market might be confined to a …

What are typical commision rates for SaaS sales people?…

As commission rates are a derivative of quota and incentive compensation that is a tough question to answer. What I can tell you based on our 2010 SaaS Metrics & Compensation Study is that the average MRR is $4460 and the average annualized quota is $8…